The Greatest Guide To Clark Wealth Partners

The Best Guide To Clark Wealth Partners

Table of ContentsThe 10-Second Trick For Clark Wealth PartnersLittle Known Questions About Clark Wealth Partners.The Ultimate Guide To Clark Wealth PartnersLittle Known Questions About Clark Wealth Partners.Not known Factual Statements About Clark Wealth Partners The 8-Second Trick For Clark Wealth PartnersThe Buzz on Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.

Whether your goal is to take full advantage of lifetime giving, ensure the treatment of a reliant, or assistance philanthropic causes, tactical tax and estate planning helps protect your legacy. Investing without a technique is just one of one of the most common challenges when building riches. Without a clear strategy, you may yield to stress marketing, frequent trading, or portfolio imbalance.I've attempted to discuss some that indicate something You really want a generalist (CFP) who may have an added credential. The CFP would certainly then refer you to or work with attorneys, accounting professionals, etc.

Not known Details About Clark Wealth Partners

Additionally this is probably on the phone, not personally, if that matters to you. payments. (or a mix, "fee-based"). These organizers are in component salespeople, for either investments or insurance policy or both. I would certainly remain away however some people fit with it - https://pxhere.com/en/photographer-me/4831754. percentage-of-assets fee-only. These planners get a charge from you, but as a percent of investment possessions took care of.

There's a franchise Garrett Preparation Network that has this kind of coordinator. There's a company called NAPFA () for fiduciary non-commission-based organizers.

The Single Strategy To Use For Clark Wealth Partners

There have to do with 6 textbooks to dig through. You won't be a knowledgeable expert at the end, but you'll know a whole lot. To get a real CFP cert, you require 3 years experience in addition to the programs and the exam - I haven't done that, just guide knowing.

bonds. Those are one of the most crucial investment choices.

Rumored Buzz on Clark Wealth Partners

No two individuals will have quite the exact same collection of investment methods or options. Relying on your objectives as well as your tolerance for risk and the moment you need to pursue those objectives, your consultant can aid you identify a mix of investments that are proper for you and created to help you reach them.

A FEW THINGS YOU Ought To KNOWAlly Financial Inc. (NYSE: ALLY) is a leading electronic financial solutions business, NMLS ID 3015. Ally Financial institution, the company's straight banking subsidiary, supplies a variety of deposit product or services. Ally Bank is a Member FDIC and, NMLS ID 181005. Credit scores items are subject to approval and extra terms apply.

, is a subsidiary of Ally Financial Inc. The details included in this short article is offered for basic informational objectives and need to not be interpreted as investment guidance, tax guidance, a solicitation or offer, or a suggestion to purchase or sell any kind of safety.

9 Simple Techniques For Clark Wealth Partners

Securities items are andOptions involve threat and are not ideal for all capitalists (financial advisors illinois). Testimonial the Characteristics and Risks of Standardized Alternatives brochure prior to you start trading options. Alternatives financiers may shed the entire amount of their financial investment or even more you can try this out in a relatively short time period. Trading on margin entails danger.

8 Simple Techniques For Clark Wealth Partners

App Shop is a solution mark of Apple Inc. Ally and Do It Right are authorized service marks of Ally Financial Inc.

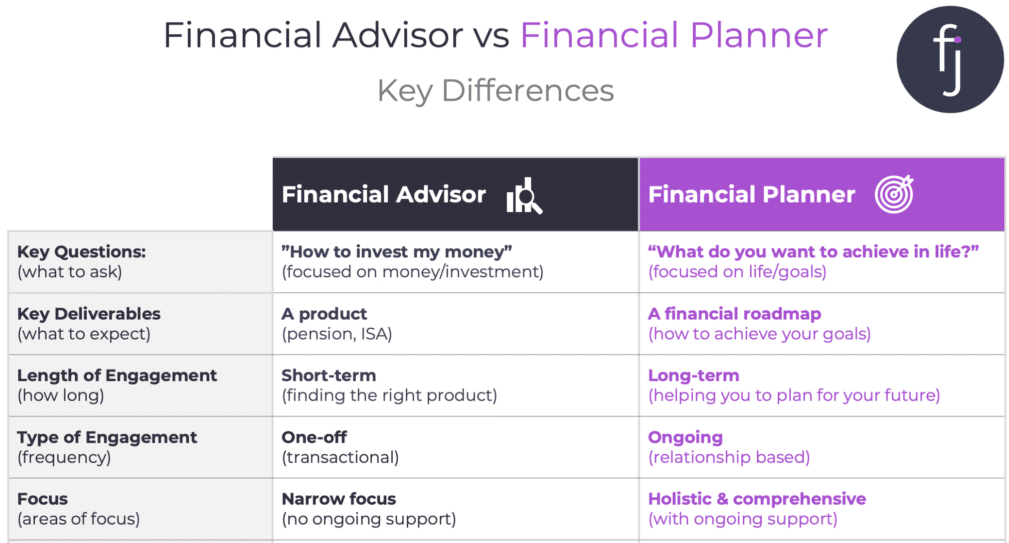

Handling your financial future can really feel frustrating. That's where financial experts and monetary organizers come inguiding you with every choice (retirement planning scott afb il).

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Market changes can cause panic, and stress can cloud large choices. A financial advisor helps maintain you based in the day-to-day, while a monetary coordinator guarantees your decisions are based on lasting goals. Together, they are unbiased and aid you browse unpredictable times with self-confidence rather than responsive emotions. Financial experts and economic planners each bring various capability to the table.

Do you prepare to retire one day? These are all practical and possible financial goals. And that's why it may be an excellent idea to enlist some specialist assistance.

Clark Wealth Partners for Dummies

While some advisors provide a wide variety of solutions, lots of specialize just in making and managing financial investments. An excellent advisor needs to be able to use guidance on every aspect of your monetary scenario, though they might concentrate on a particular location, like retired life preparation or wealth monitoring. Make sure it's clear from the get-go what the price includes and whether they'll invest more time concentrating on any kind of location.